Key Takeaways from the 2023 Frost Radar Report on Privileged Access Management

Businesses everywhere are digitizing their operations and reshaping business models. This trend, however, is creating an explosion in the number of privileged, human and non-human identities, according to Frost & Sullivan’s 2023 Frost Radar report on Privileged Access Management (PAM).

Companies today have an ever-expanding attack surface which makes them more vulnerable to sophisticated cyberattacks. Privileged access points create easy entrances that cyber criminals can exploit to access private resources. As such, companies that continue relying on outdated and ineffective PAM services risk experiencing costly attacks and service disruptions.

In light of this, demand is increasing for modern, automated, and comprehensive PAM services that integrate with other security technologies. Keep reading to learn about some key takeaways from the latest Frost Radar PAM report—and what businesses are doing to secure their hybrid environments and keep bad actors at bay.

Key takeaways from the 2023 Frost Radar PAM report

Smart businesses are prioritizing PAM investments and modernizing their services to keep up with the changing threat landscape. In fact, Frost reports, the global PAM market recorded 17.9% year-over-year growth in 2022, generating a total market revenue of $1.5 billion—a trend that’s bound to continue as we move further into the future.

The global PAM market recorded 17.9% year-over-year growth in 2022, generating a total market revenue of $1.5 billion

Unsurprisingly, the largest market for PAM is North America, accounting for roughly 40% of the total global PAM market share ahead of Asia-Pacific, Europe, the Middle East and Africa, and Latin America. Additionally, Frost & Sullivan’s report surfaces a number of other noteworthy findings; I’ll highlight some of them in this section.

Rising demand for SaaS and cloud-based PAM

Frost & Sullivan anticipates that the shift in demand for cloud-based PAM solutions and software-as-a-service (SaaS) models will continue accelerating. This makes perfect sense, as companies are embracing the cloud and SaaS PAM models to control costs and strengthen secure privileged access and identity strategies in their changing cloud environments.

The shift in demand for cloud-based PAM solutions and SaaS models will continue accelerating

What’s more, companies are racing into the cloud due to changing business priorities and ongoing remote work initiatives. Organizations today increasingly require cloud-based PAM to secure and manage identities and restrict access over distributed environments.

That doesn’t mean on-premises PAM is going away, however. In fact, Frost & Sullivan reports that on-premises solutions continue to dominate the PAM market. However, cloud-based PAM revenue is growing at a higher rate annually.

As the report explains, the deployment of PAM solutions—whether on-premises, in the cloud, or across hybrid environments — varies across industries and regions depending on business needs.

Combining PAM with cloud security features

With companies shifting security left in the development cycle and adopting cloud-native technologies, there’s a strong need for PAM solutions with built-in cloud security features.

PAM services with DevOps integration and cloud infrastructure entitlement management (CIEM) are in high demand due to their ability to secure continuous integration/continuous delivery (CI/CD) workflows, SaaS panels, and DevOps environments.

Centralizing PAM and converging functionalities

Frost & Sullivan recommends using a unified, single-pane-of-glass platform approach to centralize management and improve visibility. The platform should ideally converge different PAM functionalities like just-in-time (JIT) access and security information and event management (SIEM).

The report also recommends using a platform that supports adjacent security technologies like, VPN-less remote access, and zero trust architecture.

Evolving requirements for PAM vendors

PAM vendors play a critical role in restricting access to sensitive resources. For this reason, it’s crucial to select a vendor that’s up to date with the latest services and innovations.

Frost & Sullivan’s report mentions several factors that are essential for PAM vendors:

- New PAM product launches

- Scalable PAM products and portfolios

- Flexible deployment options and product form factors, including cloud-based, SaaS, and on-premises solutions and integration capabilities

- Ability to tailor products and services to meet unique customer needs

- Ability to integrate with other technologies like secrets management, remote privileged access, and AI/ML

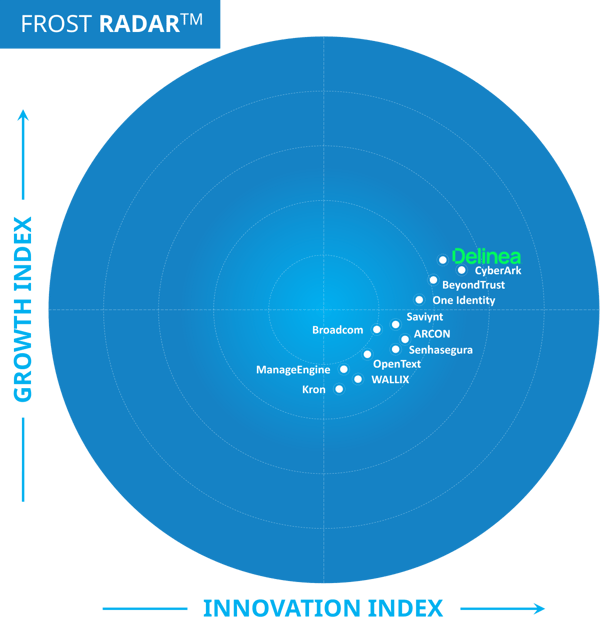

Delinea tops the Frost Radar Growth Index for innovation

The Frost Radar outlines the top PAM vendors on the market in 2023— Delinea tops the Growth Index and is a leader in the Innovation Index.

Frost & Sullivan recognizes Delinea for expanding its PAM capabilities from securing accounts, devices, and CI/CD pipelines to managing the full lifecycle of privileged accounts.

The report also mentions Delinea’s PAM offering as being considerably mature in the market. In addition, Delinea tops the Growth Index for recording tremendous year-over-year growth over the last three years.

Get the Frost & Sullivan report and find out why Delinea is a leader in the PAM space.

While you’re at it, experience Delinea with your own eyes by trying the industry-leading PAM solution for free for 30 days.