M&A Part 1: Navigating identity-related risks and safeguarding business continuity

What if your biggest security vulnerability isn't a cyber criminal but the organization you just acquired?

Acquisitions and mergers are supposed to provide a strategic advantage, but they also increase your cybersecurity risk. When two companies combine, the identity attack surface immediately doubles.

In the chaos of sudden change, who's watching your privileged identities? Identity security is one of the most critical yet often overlooked aspects of combining two organizations, and the stakes are high. The fallout from an identity-based attack could cost millions, but it's avoidable if you understand the dynamics and can close security gaps quickly.

In this blog, you’ll learn how.

Let’s explore the identity security challenges you’ll likely encounter during an M&A, how these challenges can impact your business operations, and how a comprehensive identity security strategy can mitigate your risks.

Top M&A challenges that increase identity-related risk

When your company merges, the IT environments—networks, applications, data repositories, workloads, and access controls—suddenly become interconnected.

While consolidation can lead to greater efficiencies through shared resources, it also introduces significant risks, particularly for identity security. Successful, secure integration requires thoroughly examining your respective identity security frameworks to prevent security gaps, access conflicts, and data breaches.

Below are several identity security challenges you’re likely to encounter.

1. Inconsistent identity solutions

Modern identity security involves several essential elements across multiple related disciplines, including Privileged Access Management (PAM), Identity Governance and Administration (IGA), Cloud Infrastructure Entitlement Management (CIEM), Identity Threat Detection and Response (ITDR), Identity and Access Management (IAM), Governance Risk and Compliance (GRC), and Segregation of Duties (SoD).

It's unlikely that the companies involved in the merger or acquisition use the same solutions or use them in the same way at a comparable level of identity security maturity. These systems typically vary regarding technology, access policies, and governance standards. Integrating disparate identity systems can be technically complex and introduce vulnerabilities if not done correctly.

2. Expanded identity attack surface

A merger inherently increases the attack surface. By merging IT systems, the number of privileged accounts, cloud infrastructure entitlements, and general access points multiplies. This rapid expansion increases the potential for unauthorized access and cyberattacks, especially when cloud environments, third-party vendors, or legacy systems are involved.

Suppose you're merging with a multi-cloud company or one leveraging more advanced cloud application architectures such as containers and microservices. In that case, your identity attack surface for machine identities will explode. Don’t ignore these non-human identities!

3. Unvetted identities

![]() Especially in the early stages of a merger or acquisition, it’s all hands on deck, and people are under pressure to move fast. To facilitate collaboration, you'll likely need to grant employees, contractors, and third-party service providers temporary access to sensitive data and systems before a full security review can occur.

Especially in the early stages of a merger or acquisition, it’s all hands on deck, and people are under pressure to move fast. To facilitate collaboration, you'll likely need to grant employees, contractors, and third-party service providers temporary access to sensitive data and systems before a full security review can occur.

Without proper access controls, secure remote access for employees and third parties, supported by layers of identity assurance (MFA), and identity threat protection, this interim access increases the risk of unvetted identities gaining unauthorized or excessive privileges.

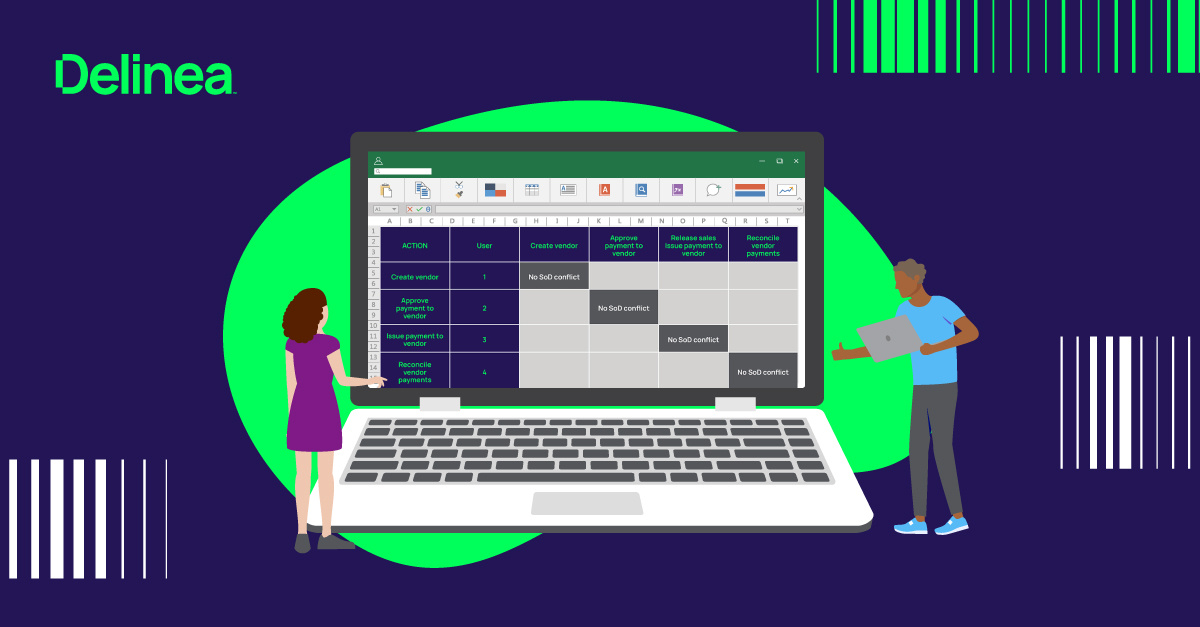

4. Segregation of Duties (SoD) conflicts

![]() SoD is a critical control to prevent fraud and conflicts of interest. You may have an established process for regular user access reviews and certification in your own organization. However, when you merge, people’s roles and responsibilities can become blurred, making it challenging to maintain precise SoD controls. In an M&A situation, lots of roles change at once, so manual processes struggle to keep up and errors are more likely.

SoD is a critical control to prevent fraud and conflicts of interest. You may have an established process for regular user access reviews and certification in your own organization. However, when you merge, people’s roles and responsibilities can become blurred, making it challenging to maintain precise SoD controls. In an M&A situation, lots of roles change at once, so manual processes struggle to keep up and errors are more likely.

Merging roles across organizations without real-time, automated governance and entitlement certification processes can lead to SoD violations. An individual who holds conflicting roles increases your risk.

5. Compliance and governance

![]() The security regulations and frameworks you use may not align one-to-one with those of the merged company. For instance, you may operate under strict GDPR or HIPAA regulations while the other has adopted the NIST's Cybersecurity Framework or SP 800-207: Zero Trust Architecture.

The security regulations and frameworks you use may not align one-to-one with those of the merged company. For instance, you may operate under strict GDPR or HIPAA regulations while the other has adopted the NIST's Cybersecurity Framework or SP 800-207: Zero Trust Architecture.

Aligning these frameworks is critical but challenging. If not correctly managed, conflicting compliance requirements can lead to data privacy violations or audits, and improper alignment can result in security and audit gaps. It’s also extremely tedious and time-consuming to map each company’s security controls and processes across multiple frameworks.

6. Orphaned accounts and shadow IT

![]() Virtually all organizations have some orphaned privileged accounts that aren’t actively managed but retain access. They also have shadow IT accounts (non-admin users with the ability to elevate permissions to admin levels, bypassing established IT policies and controls).

Virtually all organizations have some orphaned privileged accounts that aren’t actively managed but retain access. They also have shadow IT accounts (non-admin users with the ability to elevate permissions to admin levels, bypassing established IT policies and controls).

These types of accounts become more common during a merger or acquisition. They can fly under the radar, creating security loopholes. Without proactive identity governance and identity threat protection, vulnerabilities persist, opening doors for potential insider threats or external attacks.

Potential consequences of ignoring identity security

Underestimating and discounting identity security during M&A can have far-reaching consequences, affecting business performance, customer trust, and regulatory compliance.

- Increased risk of data breaches

The expanded attack surface, combined with unvetted identities and inconsistent access policies and controls, makes you more vulnerable to data breaches. Unauthorized access to sensitive information, such as customer data or intellectual property, can have severe financial and reputational consequences.

If one company's security is compromised, it could be a gateway to infiltrate the merged entity. Don’t ignore the risk of insider threats where privileged users now have access to a broader ecosystem. Be especially wary of disgruntled employees and orphaned accounts from former employees if a downsizing accompanied the merger. - Operational disruptions

The integration of identity security systems is often accompanied by identity lifecycle management challenges, including onboarding and offboarding employees, managing access for human and machine identities, and maintaining secure cloud environments.

Any use of multi-factor authentication will likely need to be expanded, but not all merged systems will accommodate MFA. If you don't address these issues promptly, you could face a tough choice: block access to systems and face productivity disruptions or grant excessive privileges, leading to increased risk. - Regulatory violations

Failing to align both companies' governance, risk, and compliance (GRC) frameworks can result in non-compliance with industry regulations such as GDPR, HIPAA, PCI-DSS, or others. Regulatory bodies may impose fines, penalties, and audits if compliance lapses occur.

Compliance violations can delay the M&A process, creating roadblocks that prevent the deal from closing smoothly. They can also result in a knee-jerk acquisition of siloed security tools to plug gaps quickly, resulting in operational overhead and technical debt.

One other thing to consider here is cyber risk insurance. Due to increased claims (mostly ransomware and data breach attacks), insurers have increased scrutiny and requirements for new applications and renewals. You face denials, skyrocketing premiums, or lower insurance limits. The challenge is that there's no prescriptive set of industry requirements; each insurer is charting its path to define what it considers necessary cybersecurity controls to mitigate these risks. - Erosion of trust

Customers, investors, and stakeholders expect security-as-usual. If identity security issues lead to breaches or operational disruptions, trust in your organization can quickly erode. Losing trust can result in customer attrition, damage to the brand's reputation, and a decline in market value. - Increased costs

Most of the above can negatively impact your bottom line. These consequences directly affect your company's profits by increasing expenses for things like incident response, legal fees, regulatory fines, service downtime, and system recovery. Not addressing identity security challenges quickly can also lead to higher remediation costs down the line.

For example, discovering a breach months after a merger may require expensive forensic investigations, legal actions, and damage control. Also, addressing compliance gaps retroactively is often more costly and resource-intensive than proactively aligning identity security during the M&A process.

Mitigating identity security risks through a comprehensive strategy

To mitigate the risks posed by identity security challenges, first and foremost, try to plan ahead! Don’t leave things until you’re in the midst of merging.

Adopt a proactive, comprehensive approach to securing identities before and throughout the M&A process.

This approach should encompass several key strategies:

1. Implement a unified identity security platform

A unified identity security platform that integrates both companies' PAM, CIEM, ITDR, IAM, IGA, and GRC systems is essential. This platform should centralize identity governance, streamline access management, and enforce consistent security policies across the newly merged entity. By consolidating identity security into a single, integrated platform, you can properly manage all user identities under the same standards and from a consistent, centralized UI.

2. Conduct comprehensive identity audits

Before granting access to sensitive resources, you should conduct a thorough identity audit of both merging companies. This audit should review existing user roles, privileged access, and cloud entitlements. Identifying orphaned accounts, dormant privileges, and redundant roles will help close security gaps and prevent unauthorized access post-merger.

Ideal is an IGA solution that performs discovery and provides a role and entitlement certification dashboard to facilitate role engineering and allow managers to review and approve access and permissions. Discovery should peer inside cloud infrastructure, on-premise servers, identity providers, and critical business applications to discover identities, groups, roles, and permissions.

3. Enforce the Principle of Least Privilege (PoLP)

During the integration, applying the Principle of Least Privilege ensures that employees and third parties have access to necessary resources based on clearly defined job roles, as well as context such as when they need access and from where. Privileged Access Management solutions help enforce this principle by managing and monitoring elevated access and authorization elevation, supporting just-in-time, just-enough privileged access request workflows, and MFA at depth. PoLP is foundational to many regulations and frameworks, such as zero trust, PCI-DSS, NIST CSF, DORA, and GDPR, so applying this principle will help you better align or comply.

4. Strengthen identity threat protection

To guard against potential identity-based attacks, implement advanced identity threat detection and response (ITDR) capabilities to monitor user behavior continuously across various systems (such as cloud platforms, identity providers, and ERP systems), detect anomalies, and respond to potential threats in real time.

By leveraging artificial intelligence and machine learning, identity threat protection can identify suspicious activity, such as credential theft or unauthorized access attempts. AI embedded in ITDR analyzes and quickly identifies anomalous activity live and in privileged session recordings.

5. Establish robust Separation of Duties (SoD) controls

Maintaining strict SoD controls throughout the merger is vital to reducing the risk of internal fraud and conflicts of interest. Identity Governance and Administration (IGA) capabilities can automate SoD enforcement, ensuring that no individual has conflicting access rights. Additionally, regular reviews and updates to access policies will help you adapt to changing roles and responsibilities, especially during the joiner/mover/leaver processes.

6. Align Governance, Risk, and Compliance (GRC) frameworks

One of the most critical components of identity security during an M&A is ensuring compliance with industry regulations. Prioritize aligning your GRC frameworks by mapping out the regulatory requirements for both companies and addressing any gaps. Automating compliance monitoring and reporting through GRC platforms will provide real-time insights and ensure the merged entity complies with data protection laws. Be sure to focus on PoLP (see above) as a core tenet.

7. Integrate cloud entitlements and access controls

Cloud Identity and Entitlement Management (CIEM) plays a crucial role in managing entitlements and access rights for organizations operating in multi-cloud environments. By integrating CIEM tools into your broader identity security framework, you can ensure that cloud resources are governed by consistent access controls, reducing the risk of misconfigurations or unauthorized access to cloud-based systems.

Stories of Merger and Acquisition security success

Stay tuned for a follow-up blog, in which you’ll learn how Delinea customers have implemented these identity security strategies to integrate a newly acquired organization, including:

- Taking control of all admin accounts in the combined infrastructure

- Consolidating remote access interface for all users (internal and third party)

- Protecting the combined server infrastructure with least privilege enforcement

During mergers and acquisitions, you can safeguard your business operations, maintain regulatory compliance, and protect sensitive data by understanding the potential risks and taking proactive steps to address them. A unified, comprehensive identity security strategy ensures the merged entity remains resilient against the evolving threat landscape. Through robust identity governance, access management, and threat protection, you can mitigate risks and unlock the full potential of your newly combined operations.

Read part 2: How to overcome identity security challenges in mergers and acquisitions