Cyber insurance coverage requirements for 2026: What insurers require to underwrite risk

By 2026, cyber insurance eligibility is increasingly determined by identity-centric security controls, with privileged access management emerging as a core underwriting requirement.

Rising claim frequency has driven premium increases and more rigorous control validation. Insurers are also reassessing AI-enabled security technologies, introducing exclusions where AI adoption introduces new or poorly governed risk.

Cyber insurance coverage has evolved from a nice-to-have safety net into a business-critical requirement. It now directly impacts an organization's financial stability and its ability to operate through disruption. For many organizations, understanding how to qualify for cyber insurance is a prerequisite for doing business.

To better understand how these pressures are reshaping coverage decisions, Delinea partnered with Censuswide to survey more than 750 security leaders on the state of their cyber insurance coverage and claims practices.

The findings underscore just how high the stakes are heading into 2026:

Together, the data points to a fundamental shift in how insurers evaluate cyber risk. Cyber insurance coverage requirements are more explicit; assessments are more rigorous, and tolerance for ambiguity is shrinking fast. For security leaders, that leaves one unavoidable question: How do we qualify for cyber insurance and ensure we stay insured?

Together, the data points to a fundamental shift in how insurers evaluate cyber risk. Cyber insurance coverage requirements are more explicit; assessments are more rigorous, and tolerance for ambiguity is shrinking fast. For security leaders, that leaves one unavoidable question: How do we qualify for cyber insurance and ensure we stay insured?

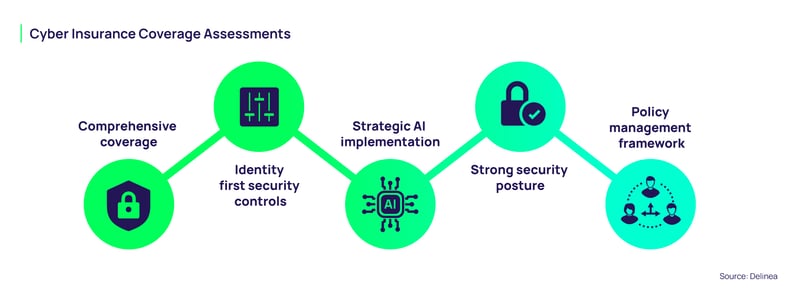

1. Conduct comprehensive coverage gap analysis

The first critical step is developing a clear, practical understanding of what your current cyber insurance policy actually covers, and where gaps may exist.

Start by mapping your policy language against your organization’s real-world risk profile. This includes identifying exclusions that could void coverage entirely, as well as working with your legal and risk management teams to understand the specific conditions that trigger those exclusions. Along the way, document every requirement your insurer has established, from mandatory security controls to reporting obligations.

From there, create a risk register that aligns your organization's most likely threat scenarios with the coverage that would apply if those events occurred. This exercise often reveals significant gaps between perceived protection and actual coverage. Use those insights to guide both security investment decisions and policy modifications during your next renewal cycle.

2. Implement identity-first security controls as a foundation

Identity security has become a cornerstone of cyber insurability. Insurers increasingly recognize that identity compromise is the gateway to most successful attacks, making control over access a primary indicator of risk and a core identity security cyber insurance requirement.

An effective identity security strategy starts with enforcing least privilege principles across all user accounts and systems. From there, organizations need to establish robust authentication mechanisms, including multi-factor authentication for all privileged access. Session monitoring and recording capabilities are also critical, providing the level of visibility insurers now expect when evaluating control effectiveness.

Taken together, these measures do more than strengthen security posture. They signal to insurers that identity risk is being actively managed, monitored, and governed.

3. Navigate AI implementation strategically

AI presents a unique paradox in cyber insurance. When applied effectively, it can strengthen security posture and improve insurability. When poorly governed, it can introduce new risks that insurers are increasingly quick to exclude.

The distinction comes down to how AI is implemented. Insurers view AI adoption favorably when it’s embedded in security controls, where it can detect threats faster and more accurately than traditional approaches. AI-powered security tools can identify anomalous behavior patterns, automate threat response, and enable proactive defense, reducing the likelihood of a claim.

However, broader AI adoption across business operations requires careful governance. Organizations need clear AI usage policies that define acceptable use cases, data handling requirements, and oversight mechanisms. Monitoring systems should be in place to detect potential AI misuse before it triggers coverage concerns or policy exclusions. Just as important, AI governance frameworks must be thoroughly documented. Insurers are looking for evidence that AI-related risks are actively managed.

4. Strengthen supply chain security posture

Supply chain risks rank among the leading causes of cyber insurance claims, making third-party risk management a critical factor in insurability. In an interconnected business environment, an organization's security posture is only as strong as the vendors and partners it relies on.

Addressing the risk starts with a more disciplined approach to vendor onboarding. Comprehensive risk assessment processes should evaluate third-party security controls before granting access, supported by contractual requirements that define security standards and incident-reporting obligations. Just as important, vendor risk management must be continuous. Insurers expect organizations to monitor third-party security posture over time, rather than relying on annual or point-in-time assessments.

Pay close attention to remote access and guest access controls, as they are common entry points for supply chain compromises. Organizations should implement controls that provide granular visibility into third-party access to their systems and enable strict enforcement. Vendor access should be time-limited, purpose-specific, and fully auditable to reduce exposure in the event credentials are misused.

Finally, incident response planning should explicitly account for supply chain compromises. Insurers want evidence that organizations can quickly identify, contain, and remediate attacks that originate through partner networks. The ability to interrupt the flow of supply chain attacks significantly reduces both the likelihood and severity of breaches.

5. Create a proactive policy management framework

The era of simple cyber insurance applications is over. Mandatory assessments and prescribed security controls represent a fundamental shift in the relationship between organizations and insurers. One that now requires ongoing engagement rather than point-in-time disclosure.

Preparing for these assessments means maintaining comprehensive, up-to-date documentation of all security controls, policies, and procedures. Insurers are looking for evidence of implementation, not just policy documents. Detailed process flows can help illustrate how security controls function in practice, while logs and audit trails demonstrate consistent adherence to security requirements over time.

Proactive engagement also extends beyond documentation, including developing relationships with your insurance broker and underwriter well ahead of renewal cycles. Regular communication about security improvements, control maturity, and program evolution helps establish credibility. Sharing measurable outcomes, such as reduced incident frequency or faster threat detection times, reinforces that your security investments are delivering real, quantifiable risk reduction.

Secure your organization's future in 2026 and beyond

Organizations that treat cyber insurance requirements as a compliance exercise may face higher premiums, reduced coverage, or policy cancellation. In many cases, misunderstandings about what voids cyber insurance coverage only become clear after a claim is denied.

Those that approach these requirements as an opportunity to strengthen their security posture, by contrast, tend to see a reinforcing effect: stronger controls reduce risk, and reduced risk leads to more favorable insurance outcomes.

The path forward requires reframing cyber insurance as a strategic security initiative rather than a standalone financial product. By prioritizing identity-first controls, governing AI adoption thoughtfully, securing supply chains comprehensively, and preparing deliberately for insurer assessments, security leaders can preserve meaningful protection while keeping insurance costs manageable.

Ready to dive deeper into the data behind these insights?

Download our latest cyber insurance report to learn exactly how to qualify for cyber insurance.

REPORT

2025 Cyber Insurance Report